Elswee Heritage Flow

Spot high-quality trade opportunities in seconds...

...by combining order-flow pressure, bar structure, volatility behavior, and trend direction

– all working together as one coherent decision framework.

You’re frustrated because…

You see price move cleanly – after you hesitated or got stopped out.

You recognize patterns like inside bars, engulfing candles, and strong Delta – but in live trading, they often fail or feel inconsistent. Some sessions they work perfectly, other sessions they don’t.

You’re left wondering:

Was that Delta actually meaningful?

Was that breakout real or just noise?

Was I trading with the trend… or fighting it without realizing?

You've probably tried...

Using fixed Delta thresholds that work in one session and fail in another

Trading inside-bar breakouts without knowing if real participation was behind them

Taking engulfing candles that looked strong – only to see price stall immediately

Relying on a moving average, but still entering counter-trend under pressure

Each tool worked sometimes. But they didn’t work together.

But the real problem is…

Most traders look at signals in isolation, while the market moves as a process.

Price doesn’t jump randomly.

It compresses.

It attracts participation.

It expands.

And it does so within a trend context.

If you’re missing even one of those pieces, entries become emotional, late, or inconsistent.

Introducing Elswee Heritage Flow

Built to align all four components – trend, structure, participation, and volatility so your decisions are driven by context, not hope.

This is not a system that reacts after the move is already underway.

It’s a flow-based approach designed to help you see when the market is storing energy, when real participation enters, and when price is ready to move – in the right direction.

How Elswee Heritage Flow reads the market

A flow-based framework that reads context before execution.

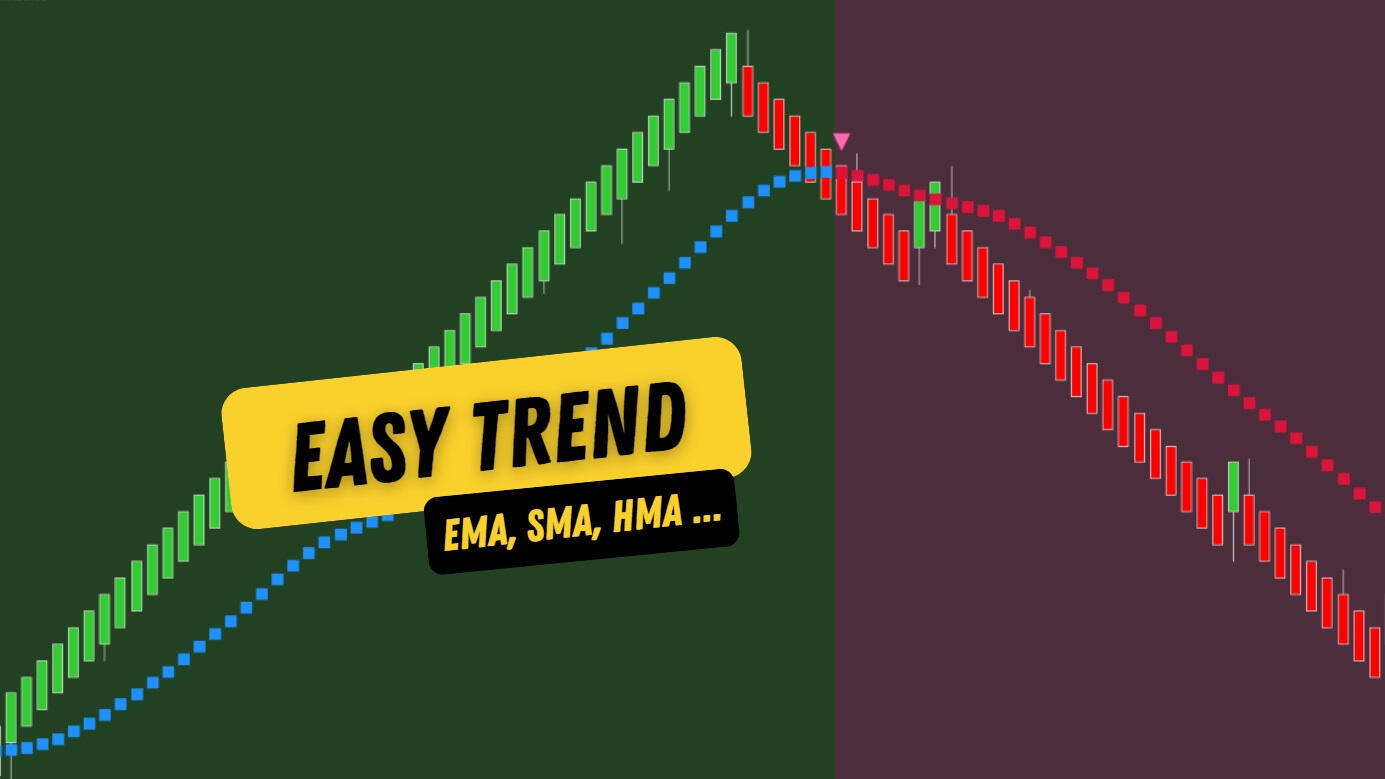

1. Trend permission – Easy Trend

Easy Trend establishes whether the market is in an uptrend, downtrend, or flat condition – visually, clearly, and without interpretation.

This alone removes a large percentage of low-quality trades by enforcing directional discipline.

This indicator answers a question: “Is trading allowed in this direction?”

2. Structure & compression – Inside Bar Pro

Once direction is defined, Inside Bar Pro identifies where price is compressing.

These consolidation zones mark areas where the market is pausing, balancing, and building potential energy.

The clearly drawn ranges and internal levels make structure visible instead of implied.

This indicator answers a question: “Where is energy building?”

3. Embedded volume context – VoluCandlez

Volume matters, but separate volume panels often distract from execution.

VoluCandlez integrates volume directly into candle colors, allowing you to see participation without leaving price action. Candle color intensity reflects volume relative to its own average – high-volume bullish candles appear deeper blue, while high-volume bearish candles appear deeper red.

Exceptional volume can also be marked directly on the chart, making abnormal participation immediately visible at key levels.

4. Participation confirmation – Quantum Vol-Delta

As price tests the edges of structure, Quantum Vol-Delta measures real buy/sell pressure using adaptive thresholds.

Instead of guessing whether Delta is “strong enough,” the indicator adjusts automatically to current market volume, revealing when participation is genuinely abnormal for the session.

This indicator answers a question: “Is real participation stepping in?”

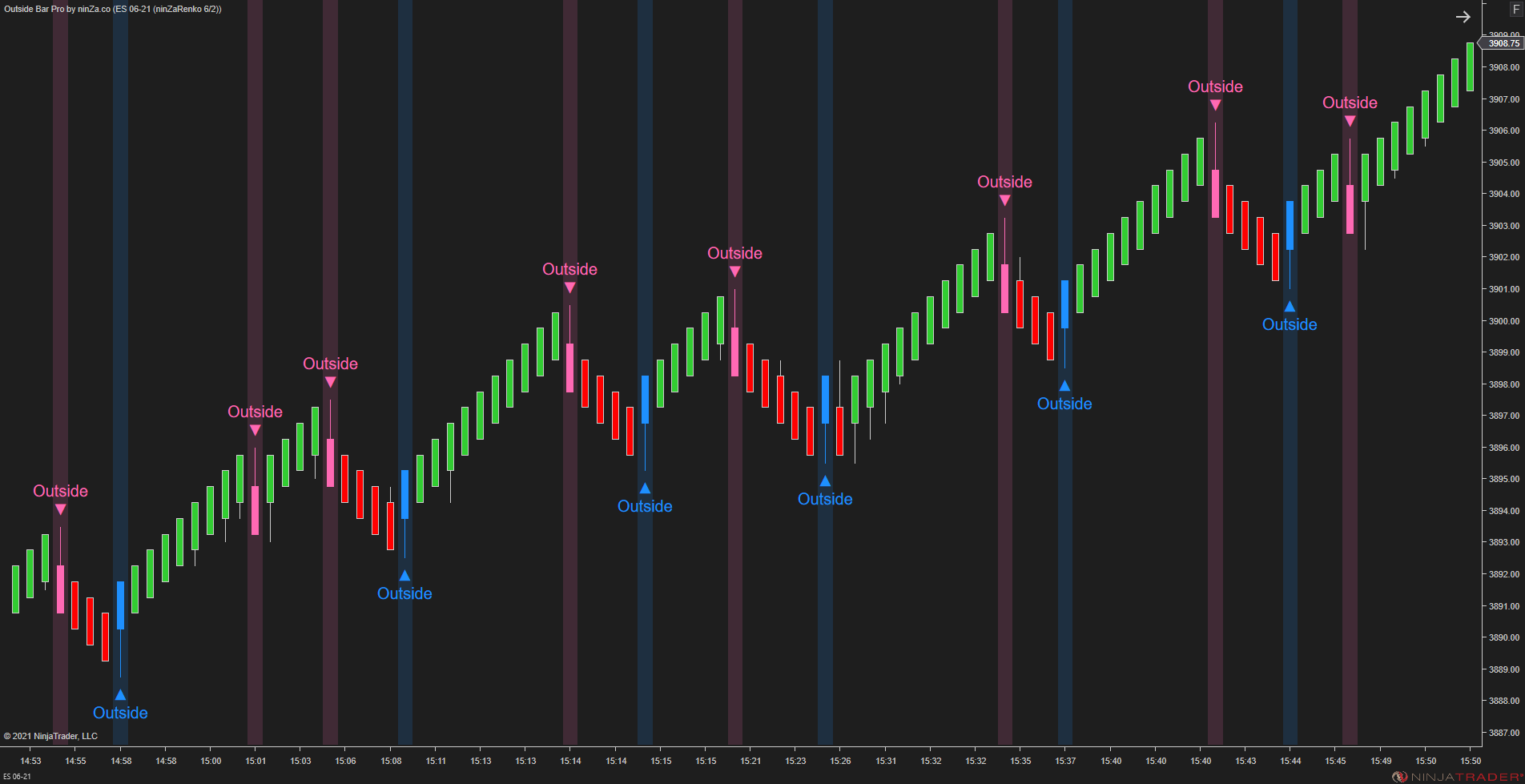

5. Expansion & execution – Outside Bar Pro

Finally, Outside Bar Pro highlights volatility expansion and decision candles.

When range expansion occurs, especially through engulfing behavior – it often confirms that price has accepted direction and momentum is entering the market.

This indicator answers a question: “Has volatility expanded to confirm intent?”

Why this combination matters

Individually, these tools are powerful. Combined, they filter each other.

Inside bars without Delta confirmation are ignored.

Delta spikes without structure are treated cautiously.

Volume without context is deprioritized.

Outside bars against the trend lose priority.

What remains are fewer trades – but higher-quality decisions, taken with clarity instead of reaction.

This is the difference between trading patterns and reading flow.

What remains are fewer trades – but higher-quality decisions, taken with clarity instead of reaction. This is the difference between trading patterns and reading flow.

Highlights of each indicator

Each indicator plays a specific role in the flow.

Quantum Vol-Delta

Adaptive order-flow analysis that removes fixed Delta guesswork.

Thresholds adjust automatically to changing volume conditions, revealing meaningful buy/sell dominance across all sessions with intelligent filtering for higher-quality signals.

Inside Bar Pro

Clearly defines consolidation zones and mother-bar structure.

Visual range mapping and breakout detection help traders identify where the market is storing energy and where structure actually breaks.

VoluCandlez

Embeds volume directly into candle colors using gradient intensity based on volume ratios.

Makes participation visible without a separate volume panel and marks abnormal volume at key moments.

Easy Trend

Visually enforces trend discipline using customizable moving averages and slope filtering.

Defines directional bias at a glance, reducing counter-trend mistakes and emotional entries.

Outside Bar Pro

Detects volatility expansion and engulfing behavior with flexible strictness and size filters.

Highlights decision bars that often confirm momentum and directional acceptance.

FOBE Order Flow Trading

Provides the execution and microstructure layer of the framework.

Visualizes real-time order flow via ladder columns, enabling fast and precise execution.

Elswee’s strong Trend + Order Flow strategy in Real Funded trading

In this video, you’ll see how the FOBE Order Flow Trading + Elswee Heritage Flow work together in real time.

Elswee Heritage Flow defines the broader trend bias and provides a structured price-action framework, while FOBE Order Flow Trading handles the execution layer – reading footprint, resistance, and volume behavior at key levels.

This session was traded on a MyFundedFutures account, so the psychological pressure was real. Every decision carried consequences, and the behavior you see reflects how I operate under live conditions, not hindsight or simulation.

Elswee Heritage Flow itself is designed as a modern, structured interpretation of classic technical analysis on the 1-minute chart. The focus is not prediction, but clarity, discipline, and rule-based decision-making – executing what the market presents, not what we want it to do.

What Traders Want to Know...

Clear answers to the questions traders usually ask before committing to a framework.

Elswee Heritage Flow Manual

You won’t be left figuring things out on your own.

Elswee Heritage Flow includes a dedicated manual that clearly explains how the bundle works as a trend and continuation framework – designed to filter noise and execute only when bias, structure, and intention align.

After purchasing the bundle, the Elswee Heritage Flow manual is included, providing clear guidance on how to apply the framework consistently and with discipline.

Your purchase is fully protected

Zero Risk. Full Peace of Mind.

Trade with the full indicator for 45 days – your charts, your markets, your strategy.

If it doesn’t noticeably improve your timing, clarity, or trade quality, we’ll exchange it for any other indicator with little or no fee.